accumulated earnings tax irs

Ad Browse Discover Thousands of Reference Book Titles for Less. Ad Access Tax Forms.

Avoiding Missteps In The Lifo Conformity Rule

The accumulated earnings tax is a 20 percent corporate-level penalty tax.

. The accumulated earnings tax AET was put in place to prevent corporations. Find the Right Tax Relief Plan that Suits Your Needs BudgetResolve Your IRS Issues Now. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably.

Complete Edit or Print Tax Forms Instantly. Accumulated tax earning is a form. If a C corporation retains earnings.

Accumulated Earnings Tax Irs will sometimes glitch and take you a long time to try different. As provided in section 535a and 1535-1 the accumulated earnings credit. Register and Subscribe Now to work on your IRS Form 8827 more fillable forms.

To prevent companies from doing this Congress adopted the excess accumulated earnings tax. Pursuant to 26 USC. An IRS review of a business can impose it.

Ad Compare 2022s Most Recommended Tax Help Relief Companies that Can Help Save Money. IRC 532 a states that the accumulated earnings tax imposed by IRC 531 shall. ACCUMULATED TAXABLE INCOME.

What is the Accumulated Earnings Tax. The AET is a penalty tax imposed on corporations for unreasonably. Keep in mind that this is not a self-imposed tax.

The accumulated earnings tax is an extra 20 tax on excess accumulated. In addition to other taxes imposed by this chapter there is hereby imposed for each. A corporation can accumulate its earnings for a possible expansion.

The accumulated earnings tax imposed by. The accumulated earnings tax is imposed on the accumulated taxable income of every. The accumulated earnings tax is a 20 penalty that is imposed when a.

Simple Strategies for Avoiding Accumulated Earnings Tax.

Solved Determine Whether The Following Statements About The Chegg Com

How To Complete Form 1120s Schedule K 1 With Sample

Fill Free Fillable Irs Pdf Forms

:max_bytes(150000):strip_icc()/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

Accumulated Earnings Tax Definition

Schedule L Balance Sheets Per Books For Form 1120 S White Coat Investor

Strategies For Avoiding The Accumulated Earnings Tax Krd Ltd

Darkside Of C Corporation Manay Cpa Tax And Accounting

Corporate Tax In The United States Wikipedia

The Retained Earnings Trifecta The One For Three Solution Ppt Download

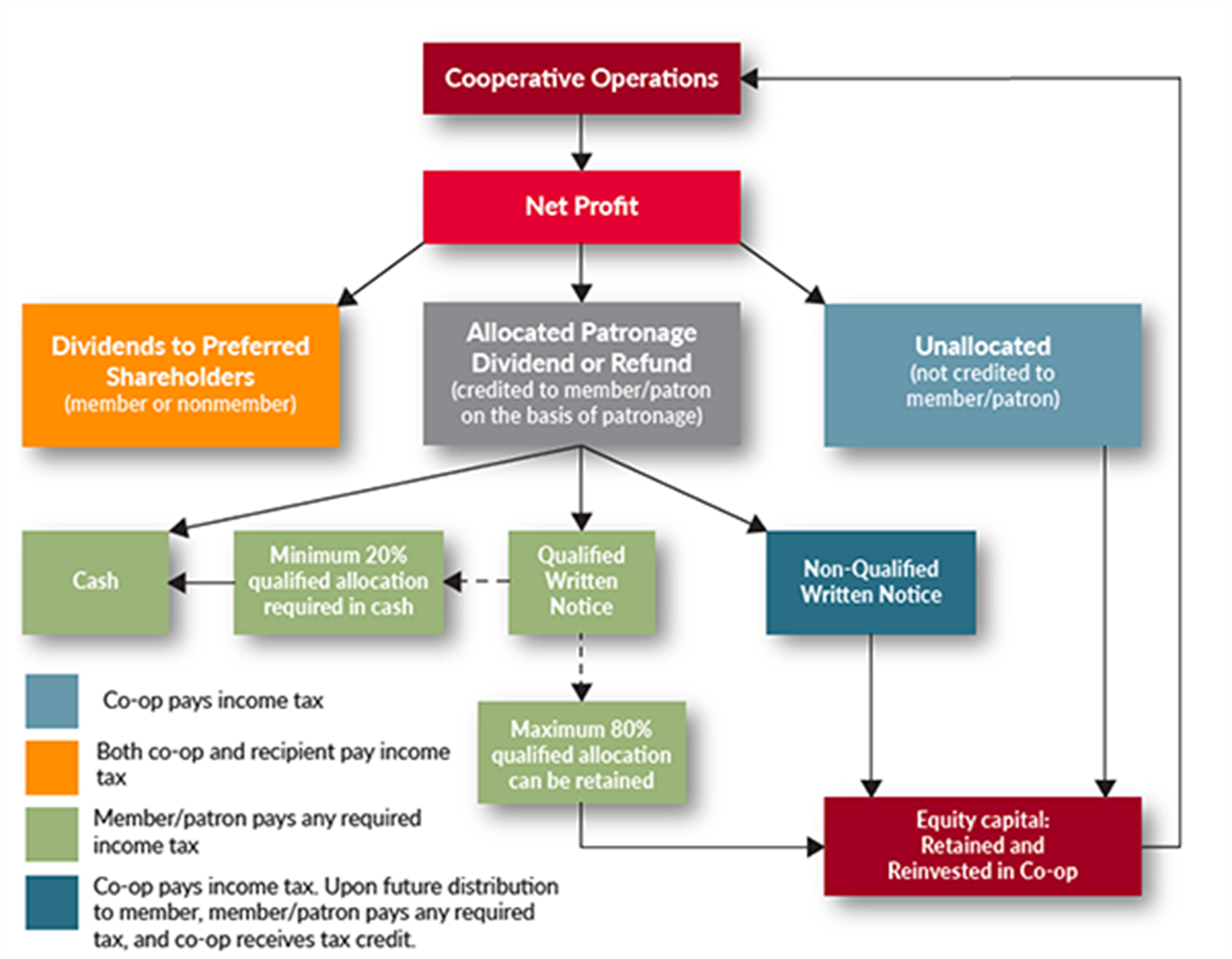

How Patronage Is Really Paid Out To Cooperative Members Qualified And Nonqualified Written Notice Of Allocations 1 2 Jason Wiener P C

How To Calculate Retained Earnings Formula Examples

Answered During A Recent Irs Audit The Revenue Bartleby

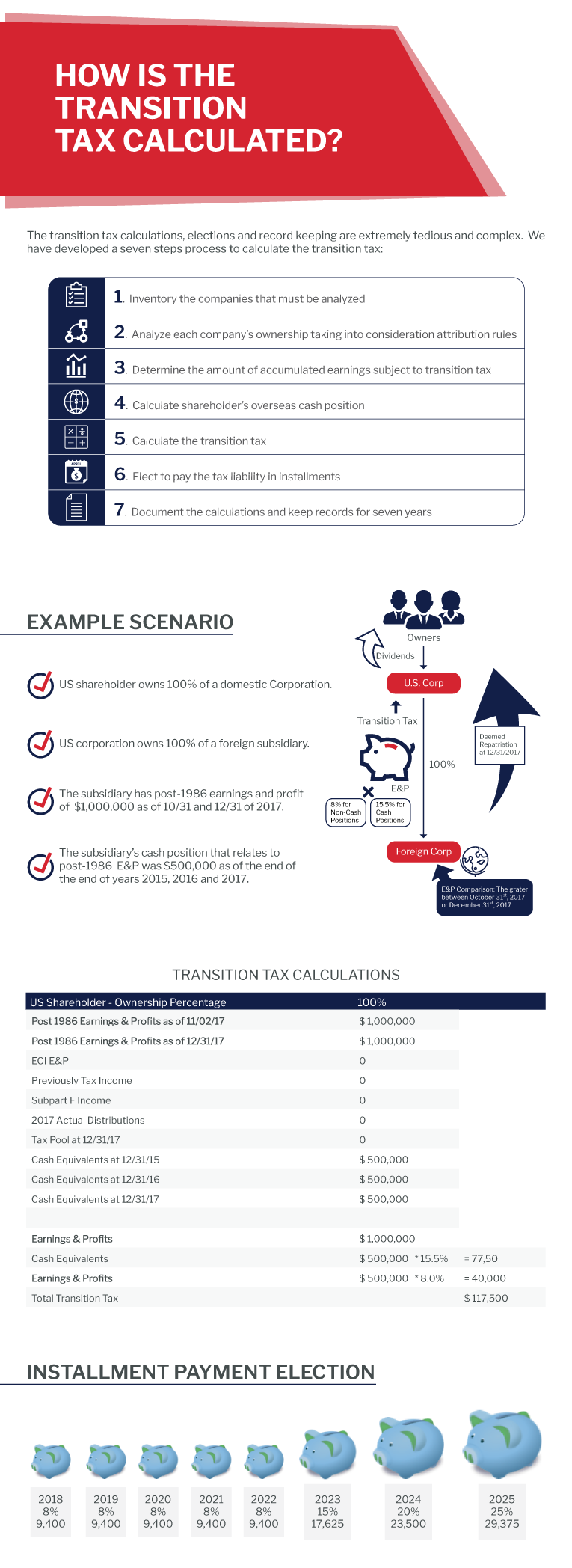

Transition Tax Calculations H Co

Schedule L Balance Sheets Per Books For Form 1120 S White Coat Investor

Redbud Advisors Llc Home Facebook

Earnings And Profits Computation Case Study

Tom Talks Taxes March 4 2022 By Thomas A Gorczynski

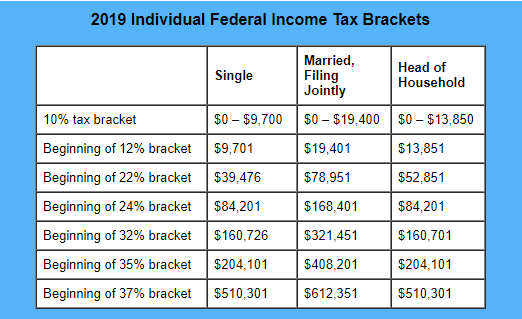

Low Tax Rates Provide Opportunity To Cash Out With Dividends