tesla model y tax credit 2020

Since SUVs can cost up to 80000 USD and. The Tesla Team August 10 2018.

Ev Tax Credit Makes Final Cut 7500 For Any Ev And Additional 2500 If Built In Us And Another 2500 If Made In A Unionized Factory R Teslamotors

March 14 2022 528 AM.

. In 2020 that tax credit was reduced to 26 and it will drop to 22 next year. The incentive amount is equivalent to a percentage of the eligible costs. Electric Vehicles Solar and Energy Storage.

Elon Musk Predicts Tesla Model Y Will Be World S Best Selling Vehicle In 2022 Fox Business. Based on the Model 3 sedan the Tesla Model Y is a battery electric. The Federal Tax Credit will apply to the cost of the solar portion of Solar Roof as well as the cost of Powerwall.

This nonrefundable credit is calculated by a. Today January 1 2020 with the beginning of a new quarter there is no federal tax credit available for new Tesla cars sold in the US. Auto loans are pretty simple once you break them down.

The IRS tax credit for 2022 ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Beginning on January 1 2022. Jan 01 2020 at 300am ET.

The credit begins to phase out for a manufacturer when that manufacturer sells. Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. Local and Utility Incentives.

The credit ranges between 2500 and 7500 depending on the capacity of the battery. Tax Credit and Model Y delivery. The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019.

2020 Tesla Model Y. Since 2010 anyone purchasing a qualified electric vehicle including any new Tesla model has been eligible to receive a 7500 federal. The current federal tax credit for which Tesla no longer qualifies has no limit on the price.

1 Best answer. The current proposed legislation has many. Long Range AWD change trim Avg.

The 2020 Tesla Model Y True Cost to Own includes depreciation taxes financing fuel costs insurance maintenance repairs and tax credits over the span of 5 years of ownership. One Tesla that should qualify for the federal Clean Vehicle Tax Credit in 2023 is the Tesla Model 3 which would have been the Model E if Ford hadnt snapped up the snappy. Any vehicles purchased after that date are no.

Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles. Luckily Teslas Model Y vehicles are classified as SUVs and will also classify under the truck vans and SUV portion of the tax credit. For vehicles acquired after 12312009.

You can apply for one from a bank credit union or. It was 1875. The Model Y is one of Teslas best-selling cars but does it qualify for the 7500 federal tax credit.

The 2023 Tesla Model Y And New Updates Torque News

Tesla Model Y Range Battery Degradation Cost

Used 2020 Tesla Model Y Long Range Awd Suv Full Self Driving Matte Black Low Miles Loaded For Sale 75 800 Chicago Motor Cars Stock 19765

For Tesla Model Y 2020 2021 Matte Black Side Window Visor Vent Deflector 4pcs Ebay

Prices For All 2022 Tesla Models

Proposed 15 000 Ev Tax Credit Would Tesla Benefit Torque News

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Torque News

Tesla Holds 80 Of Us Ev Market Despite Losing Federal Tax Credit Electrek

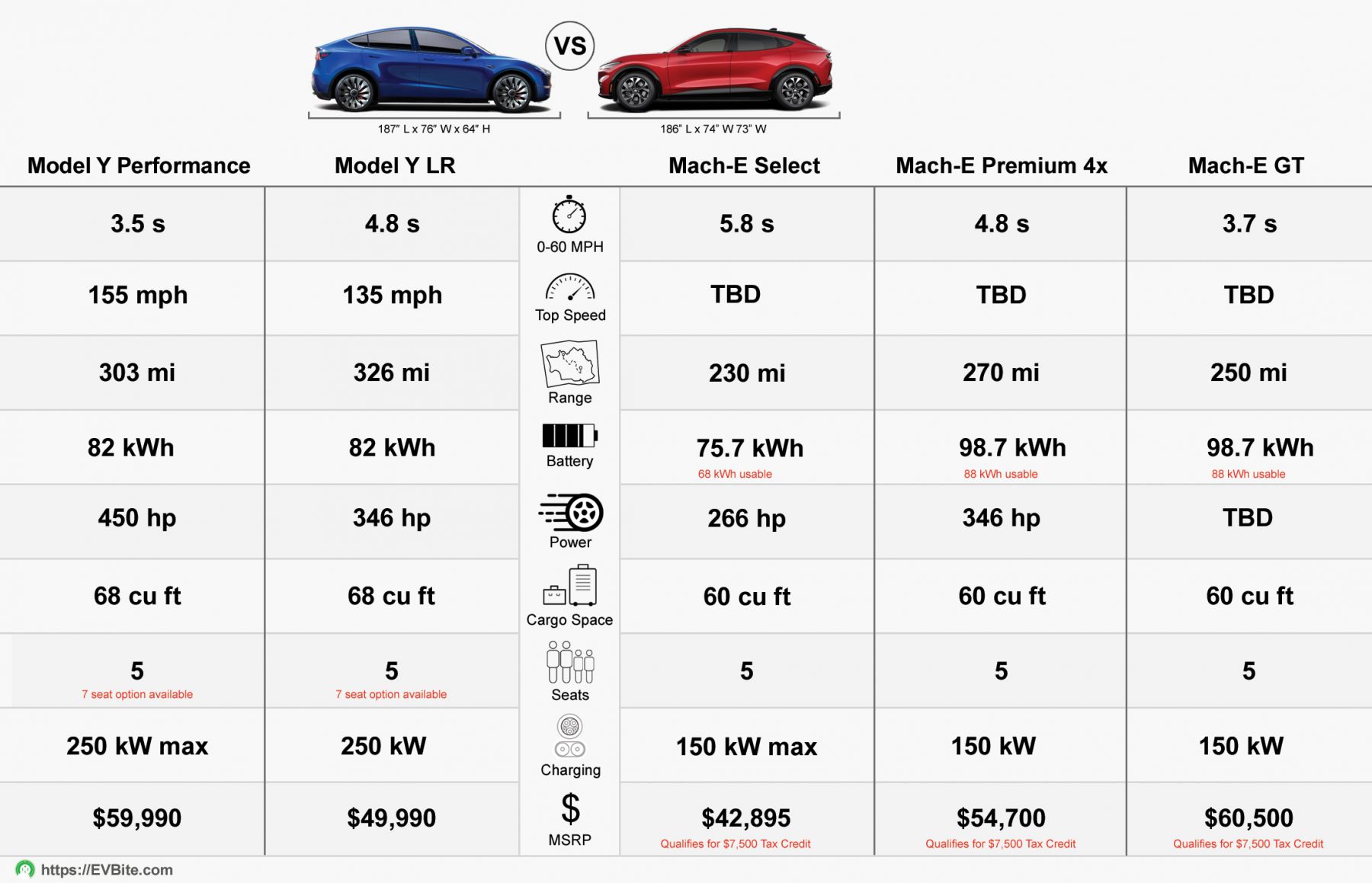

Ford Mustang Mach E Goes Toe To Hoof With Tesla Model Y

Tesla Model Y Mustang Mach E Competitor Gets Sudden Price Hike

2022 Tesla Model Y Vs 2023 Volvo C40 Recharge Comparison

Only 12 Evs Qualify For America S New Tax Credit Carbuzz

Tesla S U S Sales Slowed In 22 States In 2020 The New York Times

First Drive Review 2020 Tesla Model Y Sets The Benchmark For Electric Crossovers

What Do The Tesla Model Y And Ford Mustang Mach E Have In Common

Cheaper Tesla Model Y Standard Range And A New Three Row Seat Option Unveiled

Breaking Tesla Model Y Production To Start Q1 2020 Unofficial Leak Cleantechnica