does wyoming have sales tax on cars

A sales or use tax is due prior to first registration. State wide sales tax is 4.

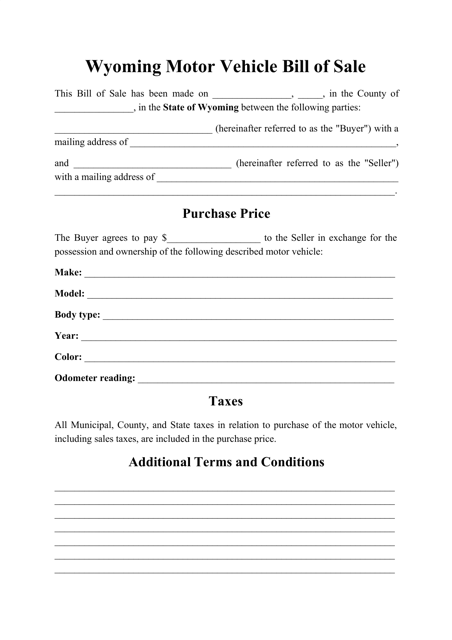

Free Wyoming Motor Vehicle Dmv Bill Of Sale Form Pdf

4 percent state sales tax one of the lowest in the United States.

. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. The state of Wyoming does not usually collect sales taxes on the vast majority of services performed. How much is vehicle sales tax in Wyoming.

Does wyoming have sales tax. No entity tax for corporations. The sales tax rate is always the rate charged in the purchasers county of residence as indicated by the address on the title.

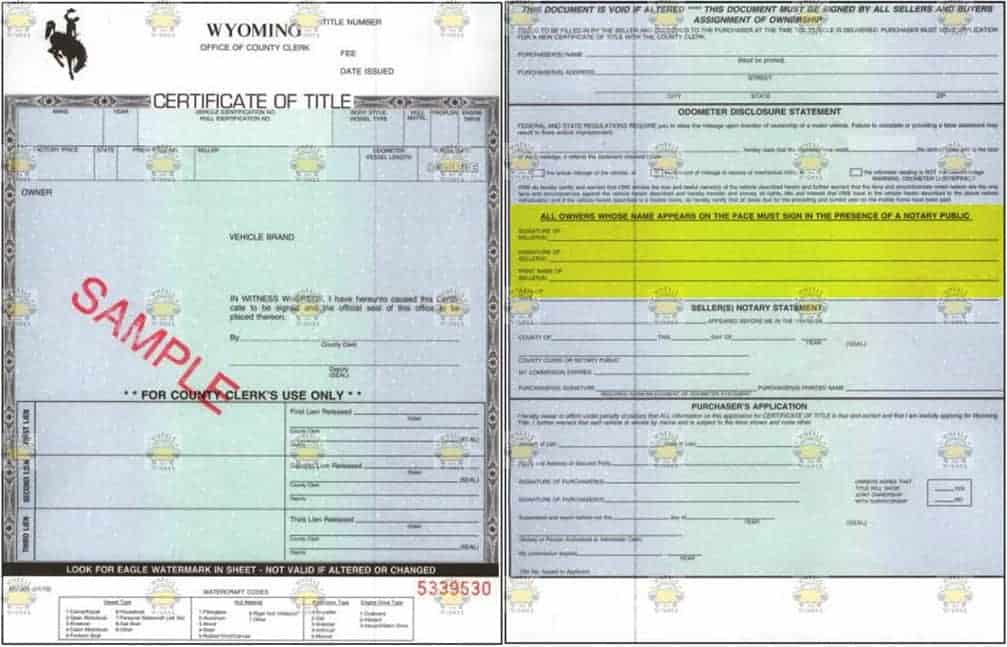

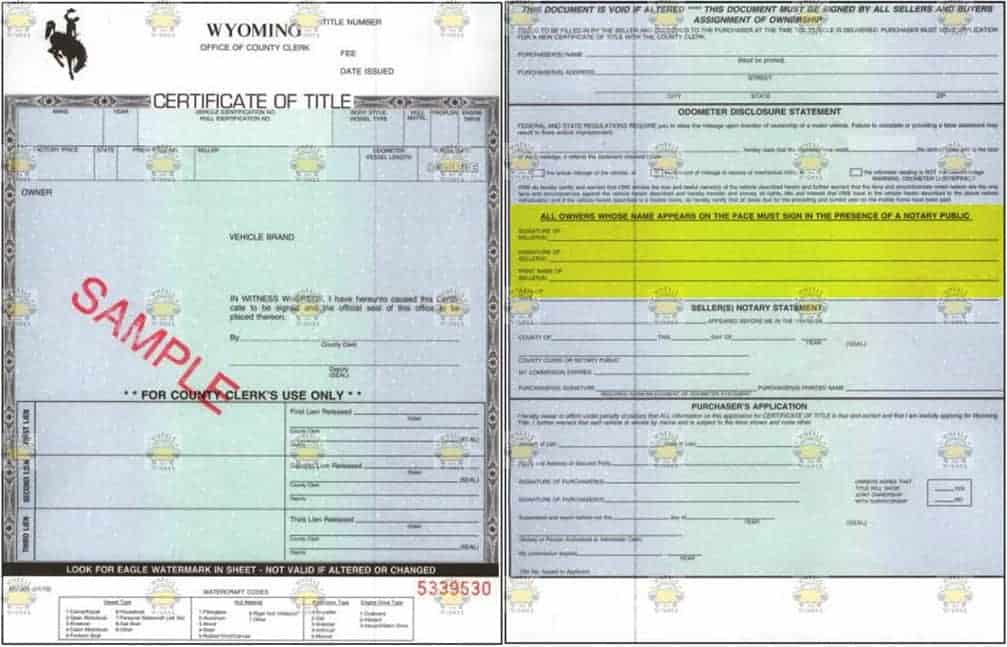

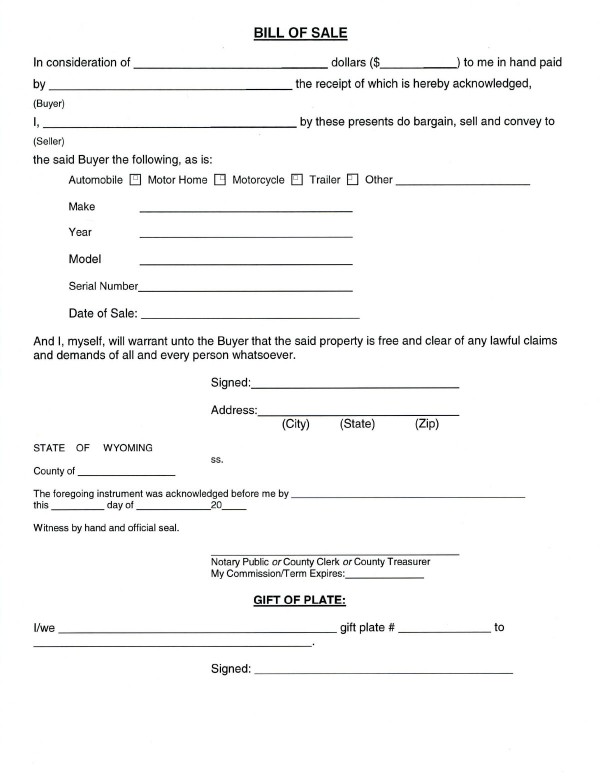

On top of the state sales tax there may be one or more local sales taxes as well as one or. Wyoming does not use a formal bill of sale and some counties provide one while others rely on the transaction parties to provide one. Some services in Wyoming are subject to sales tax.

Classic cars have a rolling tax exemption ie vehicles manufactured more than 40 years before 1 January of that year are automatically exempt from sales tax and vehicles used. However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in. How To Calculate Sales Tax And Vehicle.

If the purchase was made out of state the tax rate will be. When buying a vehicle. ATVs Motorcycles If you purchased an ATV or.

Have a question or. No personal income taxes. Some of the advantages to Wyomings tax laws include.

The tax fee is based on your countys tax rate. Sales tax on motor vehicles is due within 65 days of the date of purchase or penalties and interest will be assessed by the County Treasurer. Payment of Sales Tax on Motor Vehicles.

Wyoming collects a 4 state sales tax rate on the purchase of all vehicles. This is a one-time fee levied when you first register a vehicle after a purchase. Use tax applies where the purchase occurred outside of Wyoming and is for the use storage or consumption of the vehicle within Wyoming.

How long do you have to pay sales tax on a car in Wyoming. We have almost everything on ebay. See the publications section for more information.

Currently combined sales tax rates in wyoming range from 4 to 6 depending on the location of the sale. In addition Local and optional taxes can be assessed if approved by a vote of the citizens. What is Wyomings Sales and Use Tax.

Wyoming collects a 4 state sales tax rate on the purchase of all vehicles. Use tax applies there the purchase occurred outside of Wyoming and is for the use storage or consumption of the vehicle within Wyoming. In addition to taxes car purchases in Wyoming may be.

Selling Without a Title It just cant be done. Mclaren P1 Takes The Stage To Show Off It S Beautiful Design Video Super Cars Mclaren P1 Normal Cars. Groceries and prescription drugs are exempt from the Wyoming sales tax Counties and.

An example of taxed services would be. Wyoming law requires that sales tax must be paid on a. Does wyoming have sales tax on cars Friday March 4 2022 Edit.

Are services subject to sales tax in Wyoming. Wyoming first adopted a general state sales tax in 1935 and since that time the rate has risen to 4.

Wyoming Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Fillable Form Vehicle Bill Of Sale Bills Things To Sell Types Of Sales

Personal Vehicle Not Commercial

Used Cars For Sale In Cheyenne Wy Cars Com

What S The Car Sales Tax In Each State Find The Best Car Price

Fillable Form Wyoming Vehicle Registration Mv 300a Wyoming Registration Fillable Forms

Wyoming Vehicle Donation Title Questions

Gifting A Car In Wyoming Getjerry Com

Pin By Annette Waller On Wyoming Proud Old Gas Stations Wyoming Carbon County

Five Highlights From The Frankfurt Auto Show The Economic Times Auto Frankfurt New Cars

2021 Kia Seltos Kia Small Suv New Suv

Nj Car Sales Tax Everything You Need To Know

Sales Tax On Cars And Vehicles In Wyoming

Bills Of Sale Forms In Wyoming Facts Requirements In 2020

Vehicle Buying Do You Pay Sales Tax For The State You Buy From Or Live In

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming